If you have any questions about the Small Business Incentive Program, please contact our team at SBIncentive@sturgeoncounty.ca.

Incentives

Sturgeon County is Committed to Being Globally Competitive

Enhance your profitability by taking advantage of our investment incentives.

Energy Value Chain Incentive

Alberta’s Industrial Heartland is poised to attract up to $30 billion in new capital investments. Our highly competitive incentive program offers municipal tax exemptions between 1.5 and 2.5 per cent of eligible project capital costs for energy value chain projects.

Overview

Sturgeon County is a proud and founding member of Alberta’s Industrial Heartland Association (AIHA). The Heartland is Canada’s largest hydrocarbon processing region and is a world-class location for the development of major industrial projects in the energy and petrochemical value chains. The Heartland is responsible for 43 per cent of Canada’s annual basic chemical manufacturing output and has a geographic footprint of 582 square kilometres (225 square miles). Sturgeon County’s portion of the Heartland is roughly 100 square kilometres.

Incentive Details

This incentive is supported by the Heartland Incentive Bylaw (amendment).

New construction and expansion projects in Sturgeon County’s portion of the Heartland could be eligible for a municipal tax exemption between 1.5 and 2.5 per cent of eligible project capital costs.

A valuable competitive differentiator of Sturgeon County’s incentive is the focus on environmental, social and governance (ESG) criteria. Projects demonstrating defined ESG criteria could access municipal tax exemptions of 2.5 per cent of eligible capital costs, while other projects could access exemptions of 1.5 per cent.

Sturgeon County’s tax exemption incentive is complementary to the Alberta Petrochemical Incentive Program (APIP), which offers grants for eligible facilities valued at up to 12 per cent of eligible capital costs.

Incentive Eligibility

To be eligible, a project must meet the following criteria:

- Be physically located within Sturgeon County’s portion of Alberta’s Industrial Heartland and within the County’s I5 – Heavy Industrial District

- Be an energy value chain project or associated infrastructure

- Be either a new construction or expansion project

- Have total eligible capital costs greater than $50 million CAD

- Employ at least 250 workers during construction or 15 permanent workers once operational

- Meet additional legal and financial requirements as outlined in the Heartland Incentive Bylaw

Application Process

We encourage interested applicants to contact our Economic Innovation and Growth team to discuss your eligibility and the application process.

Value-Added Agriculture Incentive

This incentive is supported by the Major Investment Incentive Bylaw.

New construction and expansions of value-added agricultural projects in Sturgeon County could be eligible for municipal tax exemptions between 1.5 and two per cent of eligible project capital costs.

Projects demonstrating defined ESG criteria could access municipal tax exemptions of two per cent of eligible capital costs, while other projects could access exemptions of 1.5 per cent.

The benefit term length will apply for a maximum of 10 years, with a maximum 80 per cent exemption on the incremental increase in the annual property taxes.

Incentive Eligibility

To be eligible, a project must meet the following criteria:

- Be located in Sturgeon County

- Be a value-added agriculture project

- Be either a new construction or expansion project

- Have total eligible capital costs greater than $20 million CAD

- Employ at least 50 workers during construction or 30 workers when operational

Application Process

Information about applications will be available in early 2023.

Alberta Agri-processing Investment Tax Credit

Additionally, you may be eligible for the Alberta Agri-processing Investment Tax Credit. This provides a 12 per cent non-refundable tax credit against eligible capital expenditures for corporations investing at least $10 million to build or expand agri-processing facilities in Alberta.

Solar Power Production Incentive

This incentive is supported by the Major Investment Incentive Bylaw.

New construction and expansions of solar power production projects in Sturgeon County’s portion of the Heartland could be eligible for municipal tax exemptions of one per cent of eligible project capital costs.

The benefit term length will apply for a maximum of 10 years, with a maximum 80 per cent exemption on the incremental increase in the annual property taxes.

Incentive Eligibility

To be eligible, a project must meet the following criteria:

- Be located in Sturgeon County’s portion of Alberta’s Industrial Heartland

- Be a solar power production project

- Be either a new construction or expansion project

- Have total eligible capital costs greater than $200 million CAD

- Employ at least 50 workers during construction or 30 workers when operational

Small Business Incentives

Empowering entrepreneurs in today’s competitive market.

2025 Investment intake is now CLOSED.

The program is investing $75,000 in small businesses; offering tailored support across three vital streams (education, equipment and technology, and marketing).

Incentive Eligibility

To be eligible:

- You must be located in Sturgeon County (having 25 employees or less, but greater than 1).

- You must have a valid Development Permit and be in good standing with the County.

- You cannot have received funding via this program within the last 3 years.

What are the funding details?

- Matching contribution of at least 50% from project owner is required.

- Maximum Sturgeon County reimbursement is $5,000 (minimum is $1,000).

Please read all eligibility requirements for each investment stream before applying. If you have questions, please reach out team at SBIncentive@sturgeoncounty.ca.

Investment Streams

Education

This investment stream aims to support small business owners in enhancing their skills and knowledge through educational programs such as courses, seminars, conferences or workshops.

Eligible Expenses

Include, but are not limited to, participation in programs, courses, seminars, webinars, conferences and/or workshops.

Ineligible Expenses

Include, but are not limited to, travel and accommodation, salaries, operational expense, hosting and/or hospitality, food and beverage, printing fees, internet fees, etc.

Apply Now

Equipment and Technology

This investment stream aims to support small business owners in equipment and technology purchases that will boost their business’s efficiency, productivity, security, and competitiveness.

Eligible Expenses

Include, but are not limited to, automation software/equipment, equipment replacement (where replacement creates efficiency/improved productivity), computer hardware, smart inventory control systems, security enhancement (lighting, fencing, shatter-proof glass, etc.), electronic payment/point-of-sale system, etc.

Ineligible Expenses

Include, but are not limited to, lease or rental costs, vehicles, cellular phones, consumer grade computer technology (ex. laptops, tablets, mobile devices, software, etc.), etc.

Marketing

This investment stream aims to support small business owners in enhancing the quality and impact of their marketing efforts, making it easier for them to reach a broader market.

Eligible Expenses

Include, but are not limited to, the development of a marketing plan, marketing materials and/or advertising implementation, e-commerce and web development, etc.

Ineligible Expenses

Include, but are not limited to, sponsorship fees, website hosting and maintenance fees, staff salaries, conference/tradeshow/industry event registration fees, hospitality, food and/or beverage, travel, corporate apparel, etc.

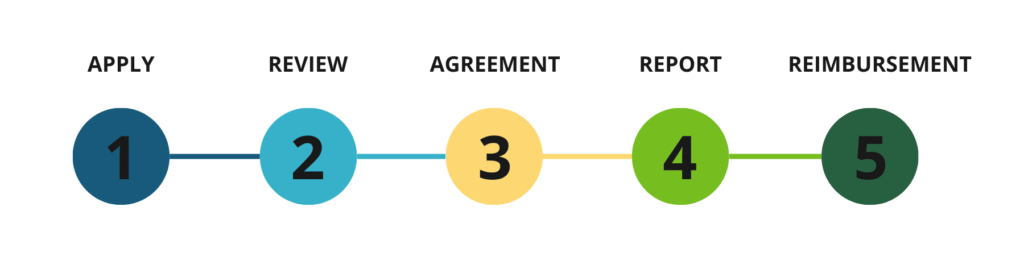

Application Process

APPLY

This incentive has a continuous intake process. The close date for applications is November 5. Applicants can start their project as soon as they’ve applied, but do so at the risk that they may not be approved for funding.

REVIEW

There are two review periods for the incentive in 2025; one on September 3 and another on November 13. Your application will be reviewed on these dates and we will contact you if there are any questions. All applicants will be notified if they are approved or not within 5 business days of the review date.

AGREEMENT

If awarded funding, you will receive an agreement with the County. This will include supplying electronic transfer information to the County for your reimbursement.

REPORT

Once your project is complete, you are required to fill out a form and submit proof of payment. This MUST be received by the County on December 1, 2025 by 4 p.m. in order to be reimbursed. If these items are not completed and received by the County by this date, no reimbursement will be issued.

REIMBURSEMENT

Once your report and expenses are received and verified you will be reimbursed via electronic tranfer within 30 business days.

Note: You can only be approved in one stream per year. After being awarded funds, you will not be eligible to receive funding again for three years.

Can I get reimbursed for a project that I already completed?

No. To be eligible for this incentive, you are required to first submit your application and quote for the work you plan to do. Once your application has been submitted you can start on any of the project work you want reimbursement for. However, you will only be reimbursed if your application is approved.

Can I apply for more than one investment stream?

No. You may only apply for one of the three streams at a time.

When will I receive my reimbursement?

Timing for reimbursement depends on when your application is approved and your required paperwork is completed. See above application process information for specific review dates and reporting deadline.

Can you provide an example of how this incentive works?

Certainly! See below.

Bob at ABC Inc. is planning to upgrade his security cameras and is applying to the Equipment and Technology stream. He has a quote from a security company for $10,000 to upgrade his cameras. Bob applies for the incentive and includes his quote, stating that he’s seeking $5,000 from Sturgeon County for the incentive.

Bob has two choices; he can wait till he gets approved to begin work or he can start the project at his owk risk as soon as he submits his application. He will find out after the next review period if he has been approved for the incentive and will be reimbursed.

If Bob is approved, he will pay the security company the $10,000 and then submit required paperwork to Sturgeon County in advance of the reporting deadline. Once all the required documents are reviewed and confirmed, Bob will receive his $5,000 reimbursement from the County via electronic bank transfer.

What if my application is not approved?

If your application is not approved, you have the option to appeal the decision directly to Council. For more information on this process, please contact our team at SBIncentive@sturgeoncounty.ca. Reasons for an application to be denied could include:

- not meeting application deadline,

- not meeting reporting requirements,

- not being in good standing with the County,

- not having a valid development permit, etc.